All Categories

Featured

Table of Contents

If you are a non-spousal recipient, you have the alternative to put the cash you inherited into an acquired annuity from MassMutual Ascend! Inherited annuities might supply a means for you to spread out your tax obligation, while allowing your inheritance to continue expanding.

Your decision could have tax obligation or various other consequences that you may not have actually considered. To assist prevent surprises, we advise talking with a tax obligation advisor or an economic specialist prior to you decide.

Lifetime Annuities and inheritance tax

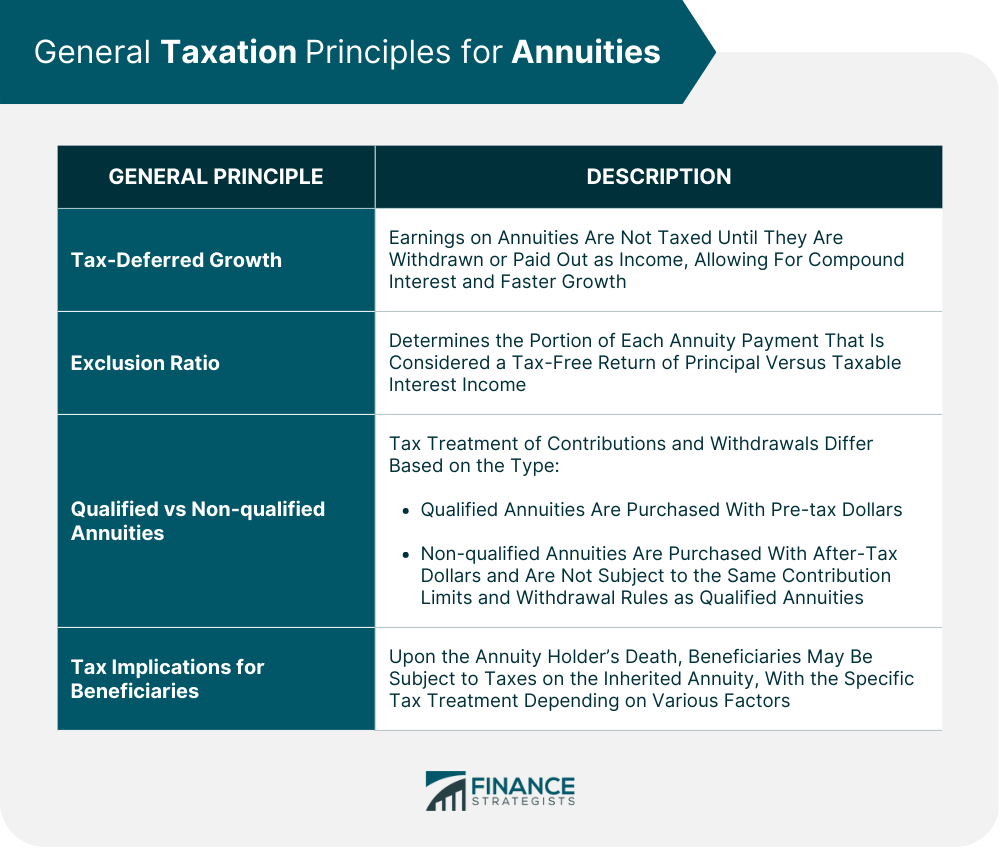

Annuities do not constantly follow the same policies as other assets. Lots of people transform to annuities to make the most of their tax benefits, as well as their unique capability to assist hedge versus the financial danger of outliving your money. Yet when an annuity owner dies without ever having actually annuitized his/her policy to pay routine revenue, the person called as recipient has some crucial decisions to make.

Let's look a lot more very closely at just how much you need to pay in taxes on an inherited annuity. For most kinds of residential or commercial property, income taxes on an inheritance are fairly basic. The common instance includes assets that are qualified wherefore's called a boost in tax basis to the date-of-death value of the acquired residential property, which efficiently gets rid of any built-in capital gains tax obligation, and gives the successor a fresh start against which to measure future profits or losses.

Taxation of inherited Annuity Payouts

For annuities, the trick to tax is just how much the deceased individual paid to buy the annuity agreement, and exactly how much cash the deceased individual obtained from the annuity before fatality. Internal revenue service Publication 575 claims that, generally, those inheriting annuities pay tax obligations similarly that the initial annuity owner would certainly.

You'll pay tax on everything over the cost that the original annuity owner paid. There is a special exception for those that are entitled to obtain surefire repayments under an annuity contract.

This turns around the common policy, and can be a big benefit for those acquiring an annuity. Inheriting an annuity can be more complicated than getting various other building as a successor.

We would certainly like to hear your concerns, thoughts, and viewpoints on the Understanding Facility in basic or this web page in particular. Your input will help us help the globe spend, better!

Do you pay taxes on inherited Flexible Premium Annuities

When an annuity owner passes away, the staying annuity value is paid out to people who have been called as recipients.

If you have a non-qualified annuity, you will not pay earnings tax obligations on the contributions section of the circulations since they have already been tired; you will only pay revenue tax obligations on the profits part of the distribution. An annuity survivor benefit is a type of payment made to a person determined as a beneficiary in an annuity agreement, usually paid after the annuitant passes away.

The beneficiary can be a youngster, spouse, moms and dad, and so on. If the annuitant had started receiving annuity settlements, these payments and any type of applicable costs are deducted from the fatality profits.

In this case, the annuity would certainly give an ensured survivor benefit to the recipient, despite the remaining annuity equilibrium. Annuity death advantages undergo income taxes, yet the taxes you pay depend on just how the annuity was fundedQualified and non-qualified annuities have various tax obligation implications. Qualified annuities are funded with pre-tax money, and this suggests the annuity owner has actually not paid taxes on the annuity payments.

When the fatality benefits are paid out, the internal revenue service takes into consideration these advantages as earnings and will certainly go through common revenue taxes. Non-qualified annuities are funded with after-tax bucks, meanings the payments have already been taxed, and the cash won't go through earnings tax obligations when dispersed. Any type of revenues on the annuity payments expand tax-deferred, and you will certainly pay revenue taxes on the incomes component of the distributions.

Tax rules for inherited Annuity Income

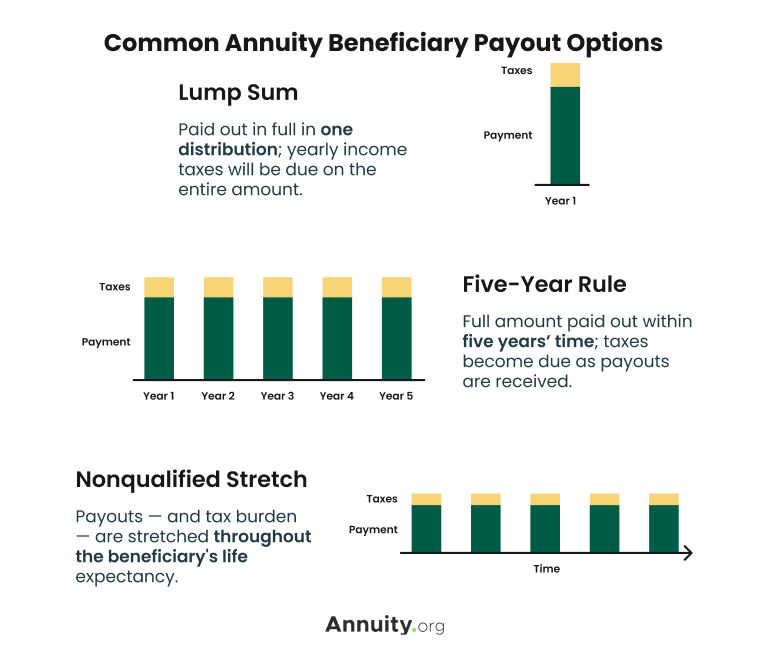

They can choose to annuitize the contract and obtain regular settlements gradually or for the rest of their life or take a swelling sum settlement. Each payment choice has various tax implications; a swelling sum payment has the greatest tax obligation consequences given that the payment can press you to a greater earnings tax brace.

You can also utilize the 5-year regulation, which allows you spread the acquired annuity repayments over five years; you will certainly pay taxes on the distributions you get annually. Recipients acquiring an annuity have numerous choices to get annuity repayments after the annuity owner's death. They include: The recipient can decide to receive the continuing to be value of the annuity contract in a solitary round figure payment.

This alternative uses the recipient's life expectancy to determine the dimension of the annuity settlements. This regulation needs beneficiaries to take out annuity repayments within 5 years. They can take several settlements over the five-year duration or as a solitary lump-sum repayment, as long as they take the complete withdrawal by the Fifth anniversary of the annuity owner's fatality.

Right here are things you can do: As a surviving spouse or a departed annuitant, you can take ownership of the annuity and proceed delighting in the tax-deferred condition of an inherited annuity. This permits you to stay clear of paying taxes if you keep the money in the annuity, and you will just owe earnings tax obligations if you receive annuity settlements.

Nevertheless, the 1035 exchange only applies when you exchange comparable annuities. You can exchange a qualified annuity for one more qualified annuity with much better features. However, you can not exchange a certified annuity for a non-qualified annuity. Some annuity contracts provide special bikers with an enhanced survivor benefit. This benefit is a perk that will certainly be paid to your recipients when they inherit the continuing to be equilibrium in your annuity.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning A Closer Look at Fixed Indexed Annuity Vs Market-variable Annuity Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Choosi

Understanding Tax Benefits Of Fixed Vs Variable Annuities Everything You Need to Know About Deferred Annuity Vs Variable Annuity What Is What Is A Variable Annuity Vs A Fixed Annuity? Pros and Cons of

Highlighting the Key Features of Long-Term Investments A Closer Look at How Retirement Planning Works Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuities Features of Smart Investment

More

Latest Posts